Description

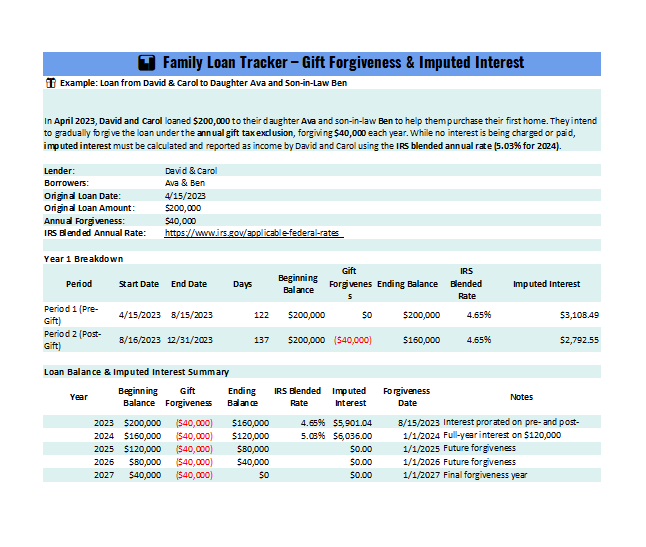

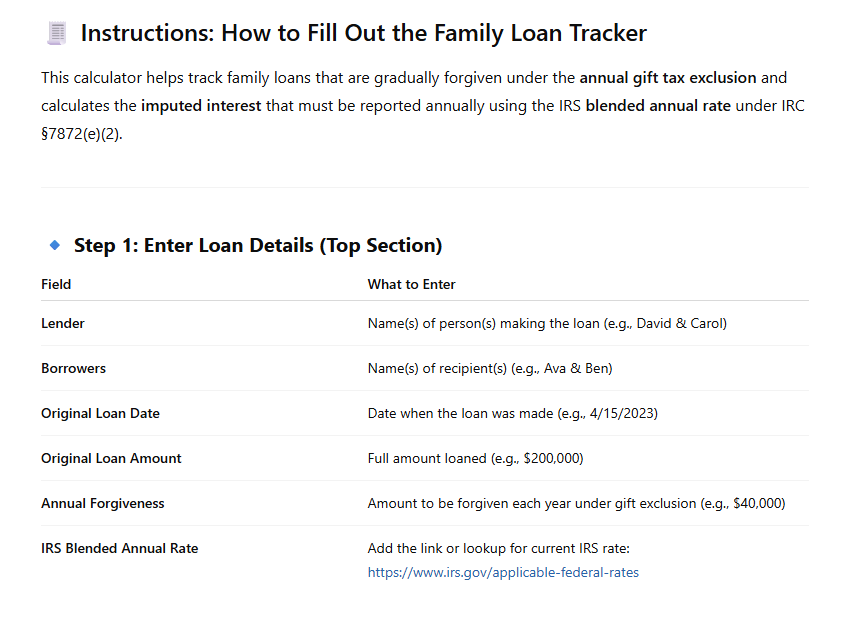

If you’ve loaned money to a family member with plans to forgive part of the balance each year under the IRS annual gift tax exclusion, this Family Loan Tracker Excel Template is an essential planning and compliance tool.

Designed specifically for parents, grandparents, and estate planners, this editable spreadsheet helps you track loan balances, annual gift forgiveness, and automatically calculate imputed interest using the IRS blended annual rate under IRC §7872(e)(2). Whether you’ve loaned funds to help your children buy a first home, cover education costs, or support their new business, this tool ensures that both the principal and interest components are accurately documented for tax reporting purposes.

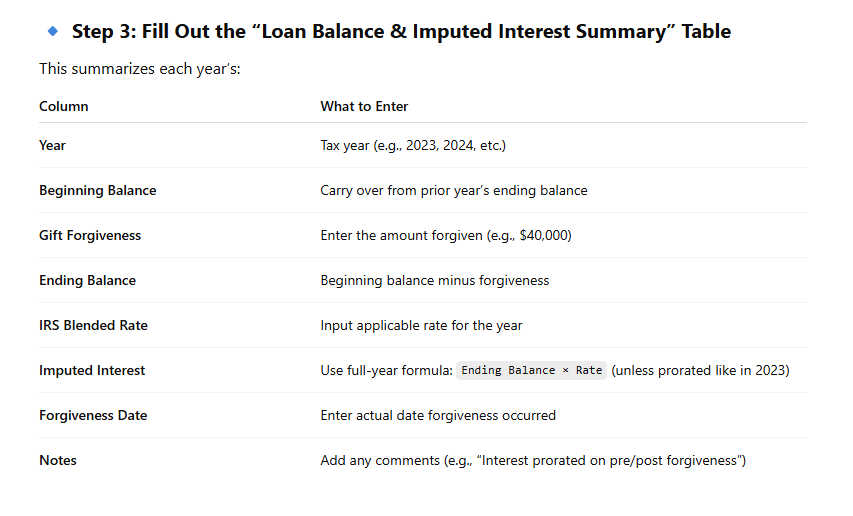

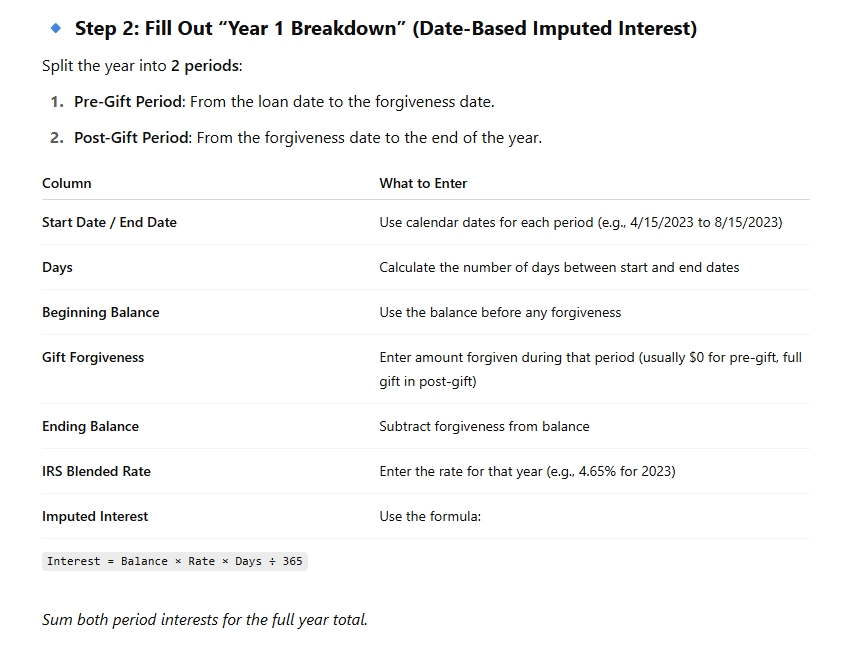

The tracker includes a built-in Year 1 interest proration calculator to split interest between pre- and post-forgiveness periods. In the following years, the tracker updates the loan balance and calculates full-year imputed interest automatically. It also includes clearly marked yellow input fields, automatic day count calculations, and a section to summarize all forgiveness and interest over a 5-year period.

This is more than just a spreadsheet—it’s a strategic tool to help families stay compliant, reduce audit risk, and simplify Schedule B reporting for imputed interest. Tax professionals can use it to support clients who engage in intra-family lending, and individuals can rely on it for clean, organized recordkeeping.

Whether you’re managing a one-time loan or part of a long-term estate and gifting strategy, this template gives you peace of mind and professional-level tracking—without the complexity.

🔧 Features at a Glance:

-

Editable Excel spreadsheet – ready to use instantly

-

Tracks annual gift forgiveness and loan balance reduction

-

Calculates imputed interest automatically using IRS blended rate

-

Handles mid-year forgiveness with accurate date-based interest proration

-

Includes 5-year summary table for forgiveness and interest

-

Clearly labeled yellow input fields for ease of use

-

Includes a built-in link to the current IRS blended rate page

-

Works for parents lending to children, grandparents, or any intra-family loan over $10,000

-

Helps support compliance with IRS Form 1040 Schedule B requirements

-

Perfect for estate planning, tax prep, and financial planning professionals

This download is ideal for families who want to lend money with love—while staying tax-smart and legally sound. Whether you’re a parent gifting over time or a tax advisor working with estate clients, this tool ensures you get it right, every year.