$25,000 Rental Loss Allowance Calculator for Active Participation (IRS Form 8582)

Easily calculate rental real estate losses with this $25,000 Rental Loss Allowance Calculator for active participants. IRS Form 8582 compliant and tax professional-approved. Instant download!

1040NR Tax Filing Checklist for Nonresident Aliens

Simplify tax filing with our 1040NR Tax Filing Checklist for Nonresident Aliens. This detailed guide helps nonresident taxpayers navigate U.S. tax laws, maximize deductions, and file Form 1040NR with confidence.

1120 Checklist: Step-by-Step Form 1120 Corporate Tax Return Preparation Guide

Simplify corporate tax filing with our Step-by-Step Form 1120 Checklist. This comprehensive guide ensures accuracy, compliance, and stress-free preparation for your corporate tax return.

Accountable Plan Bundle: Template & Guides for S Corporations and Businesses

The ultimate bundle for managing IRS-compliant reimbursements! Includes a customizable Accountable Plan Template, Accountable Plan Guide, and Accountable Plan: S Corporation for S corporations and businesses.

Client Intake Forms Bundle: Selling a Business for C Corporation, Partnership, and Sole Proprietorship – ORGANIZER FOR ACCOUNTANTS

Streamline your client onboarding process with this Client Intake Forms Bundle designed for selling C Corporations, Partnerships, and Sole Proprietorships. Perfect for accountants, tax professionals, and business advisors, this bundle ensures comprehensive and professional organization.

Conflict of Interest Letter Template Bundle + Guide for Tax & Accounting Firms

A comprehensive bundle of six conflict of interest disclosure and waiver letter templates plus a professional guide. Designed for CPAs, tax firms, and business advisors to ensure compliance, transparency, and ethical client management. Instant digital download with editable Word documents.

Essential Year-End Business Planning Checklist

Comprehensive checklist to optimize tax savings, improve cash flow, and ensure compliance for 2024.

Estate Administration: Key Tax Forms and Deadlines for Executors

Simplify estate administration with our "Estate Administration: Key Tax Forms and Deadlines for Executors" checklist. Stay organized, meet IRS deadlines, and ensure timely tax filings throughout the estate settlement process.

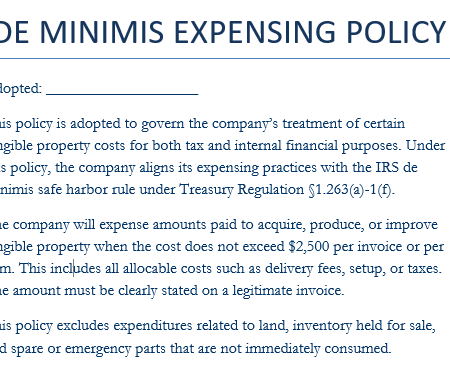

Expense Capitalization & De Minimis Policy Templates | 6 Templates + Tax Guide for Small Businesses & Accountants

Professional bundle of 6 editable De Minimis and Capitalization Policies + IRS compliance guide for tax pros and business owners.

Extension Payment Calculator | Estimate Federal & State Payments with Safe Harbor | Excel GoogleSheet Template

Easily estimate your federal and state extension payments with this professionally designed calculator for CPAs, EAs, and tax preparers. Built in Excel and Google Sheets, it applies safe harbor rules and cushion multipliers to help you confidently calculate extension amounts for 2025. Includes clear instructions and a sample tax comparison for accurate projections.

Form 1041 FINAL Return Preparation Checklist for Estates and Trusts

Comprehensive checklist for preparing the FINAL Form 1041 for estates and trusts. Covers distributions, compliance, and tax reporting.

Form 1041-A Preparation Checklist for Estates and Trusts

A detailed checklist to simplify Form 1041-A preparation for charitable trusts and ensure compliance.

Form 1065 Filing Aid: Tax Preparation Checklist

Simplify Form 1065 filing with this comprehensive tax preparation checklist. Perfect for partnerships and tax professionals.

Form 1120-F Preparation Checklist: A Step-by-Step Guide for Foreign Corporations

Streamline U.S. tax compliance with our Form 1120-F Preparation Checklist Bundle—a complete set of tools for foreign corporations. Includes checklists and intake forms for accurate and efficient reporting.