Description

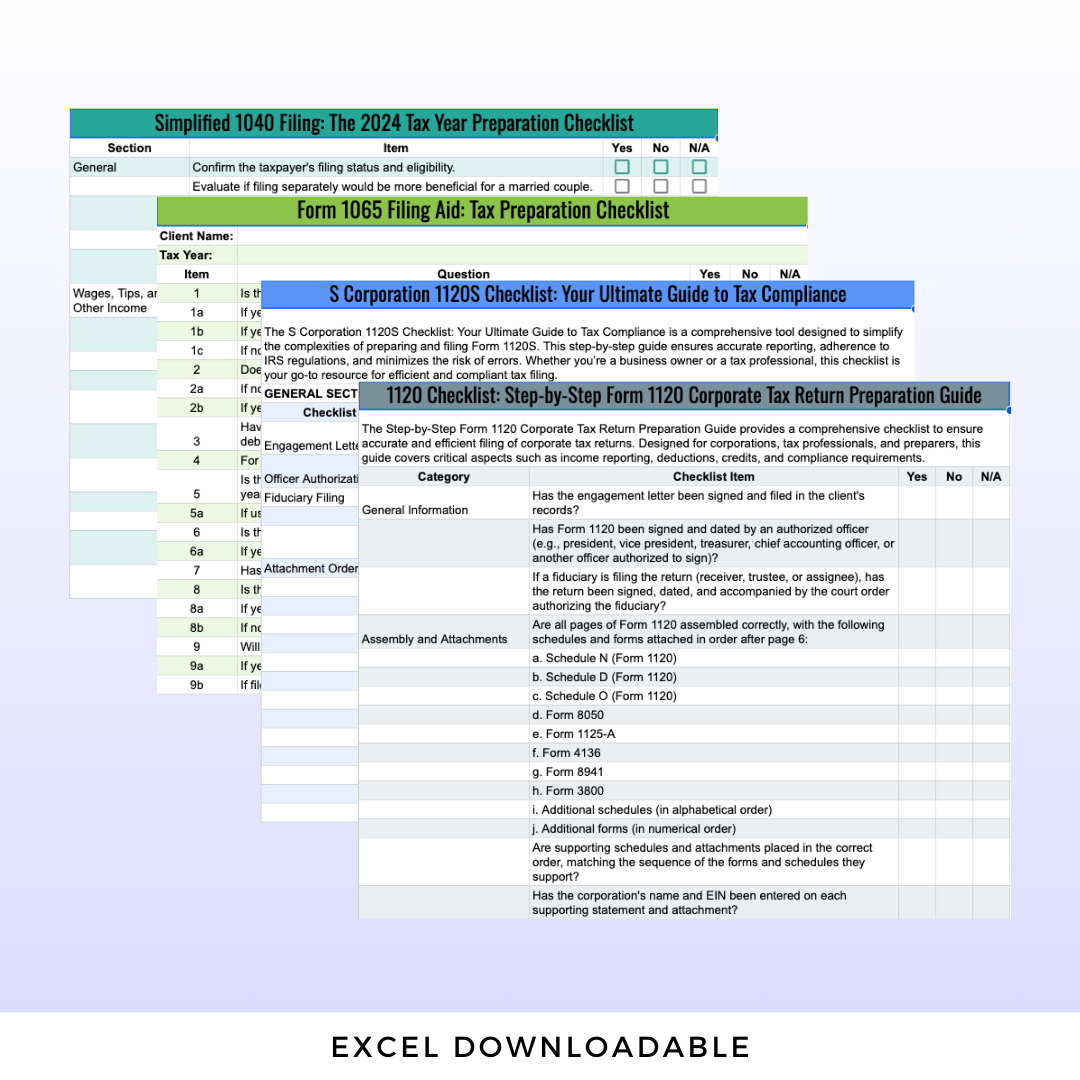

Filing your taxes can feel overwhelming, but with the Simplified 1040 Filing Checklist, you can take control of your 2025 tax season with confidence and ease. Designed for individuals, families, and small business owners, this comprehensive checklist is your go-to guide for accurate and stress-free tax preparation. Whether you’re reporting income, identifying deductions, or claiming valuable tax credits, this tool ensures no detail is overlooked.

Why This Checklist is Essential:

The IRS Form 1040 is the backbone of individual tax filings, but navigating its complexities can be a challenge. Our checklist simplifies the process, breaking it down into clear, actionable steps to help you avoid errors, maximize savings, and stay organized. It’s perfect for both first-time filers and seasoned taxpayers looking to streamline their experience.

What You’ll Gain:

- Complete Coverage: Ensure all income sources—W-2s, 1099s, investments, rental income—are accounted for.

- Maximize Deductions: Identify deductible expenses like medical costs, state taxes, and mortgage interest with ease.

- Claim Every Credit: Take advantage of the Child Tax Credit, Earned Income Tax Credit (EITC), education credits, and more.

- Step-by-Step Guidance: Tackle each section of the Form 1040 with clarity, from filing status to adjusted gross income and tax credits.

- Confidence in Accuracy: Double-check your work and avoid costly mistakes or missed opportunities.

Who Is This Checklist For?

- Individuals: Make sense of your income, deductions, and tax responsibilities.

- Heads of Household: Claim the credits and deductions you deserve while filing for your family.

- Joint Filers: Simplify the process of reporting income and credits for both spouses.

- Self-Employed: Confidently handle income from freelance work, small businesses, or side gigs.

With our Simplified 1040 Filing Checklist, you’ll have the confidence to file your taxes accurately and efficiently. Simplify your tax season, minimize your stress, and maximize your savings with this must-have tool for the 2025 tax year.

Start your stress-free tax preparation today and ensure you’re fully prepared for tax season!