Description

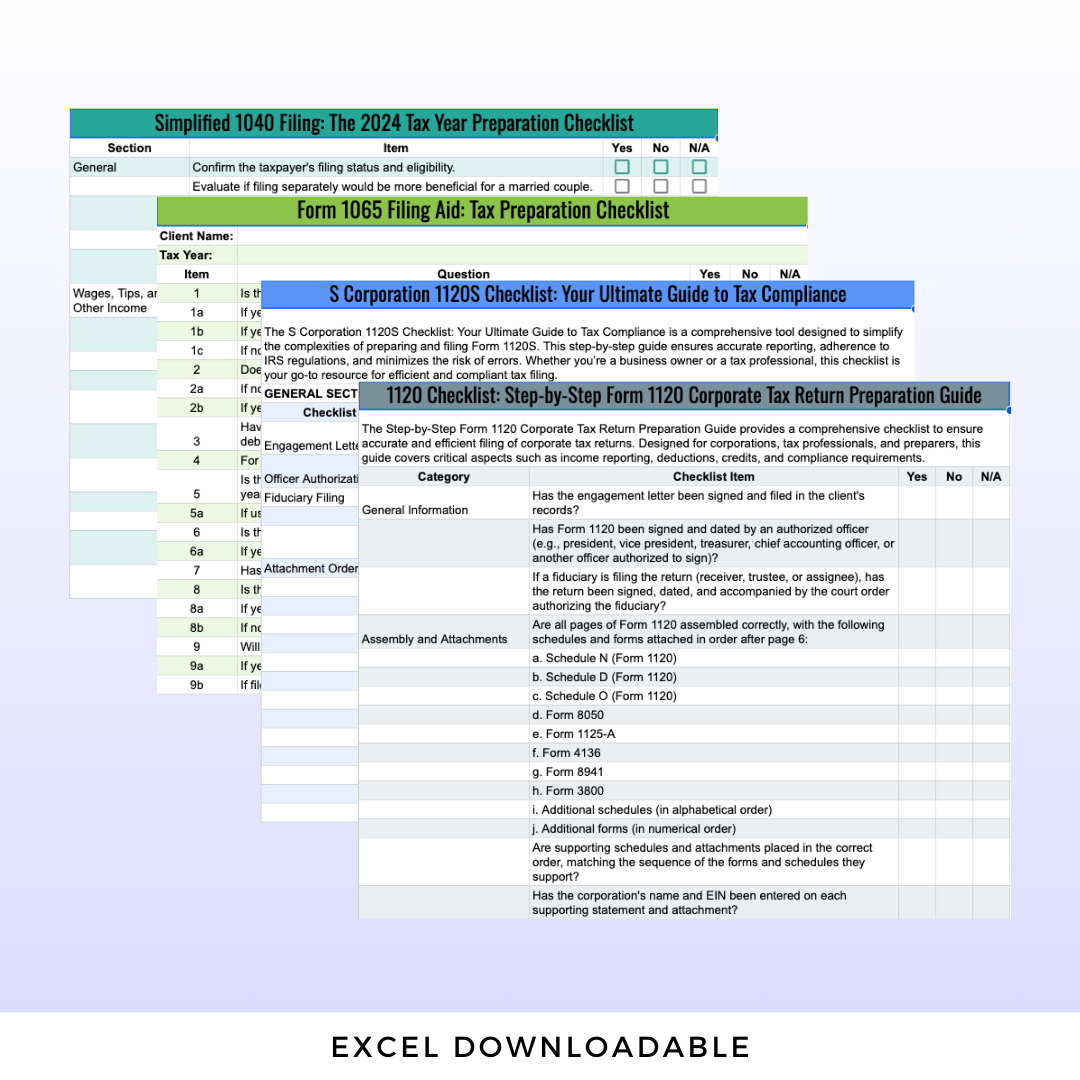

Filing Form 1065 can be a complex and time-consuming process for partnerships. Our Form 1065 Filing Aid: Tax Preparation Checklist is the ultimate resource designed to simplify this task, ensuring accuracy, compliance, and efficiency every step of the way. This comprehensive guide covers everything you need to prepare and file your partnership’s tax return with confidence. Whether you’re managing income, deductions, credits, or partner distributions, this checklist ensures you won’t miss a critical detail.

Perfect for accountants, tax professionals, and partnership managers, this checklist is tailored to the unique needs of partnerships. It provides clear instructions and prompts to keep your tax preparation process organized and stress-free. With a focus on IRS compliance, you’ll navigate even the most intricate requirements with ease, saving time and avoiding costly errors.

What This Checklist Includes:

- Income Reporting: Covers gross receipts, capital gains, rental income, and more.

- Deductions: Ensures all allowable deductions, from Section 179 to charitable contributions, are included.

- Distributions: Guidance on reporting cash, property, and securities distributions.

- Partner-Specific Information: Assistance with Schedule K-1 preparation, partner basis, and capital account reconciliation.

- Foreign Transactions: Instructions for reporting foreign income, taxes, and partnerships.

- AMT and Other Issues: Covers depreciation adjustments, disguised sales, and related-party transactions.

Why You Need This Checklist:

- Stay Organized: Streamline your tax preparation process with a clear, step-by-step guide.

- Ensure Compliance: Meet all IRS filing requirements and reduce the risk of penalties.

- Save Time: Avoid rework and costly delays by covering all necessary details upfront.

- Professional Results: Elevate the accuracy and quality of your tax filings.

Who This Checklist Is For:

- Partnerships preparing Form 1065 for the first time or seeking to improve their filing process.

- Tax professionals and CPAs managing multiple partnership clients.

- Accountants looking for a reliable tool to enhance efficiency and reduce errors.

How to Use:

- Download the checklist and review each section thoroughly.

- Check off applicable items as you gather required information and complete forms.

- Use the checklist as a guide for preparing and attaching supporting documentation.

- Refer to the checklist throughout the filing process to ensure all steps are completed.

Don’t let the complexities of Form 1065 overwhelm you. With this Tax Preparation Checklist, you’ll have everything you need to file confidently, accurately, and on time. Take the hassle out of tax season—download your guide today and streamline your partnership tax preparation!