Bookkeeper vs. Controller vs. CFO: Understanding the Differences for Your Small Business

In the dynamic landscape of small business accounting, understanding the roles of financial professionals is crucial for effective financial management. Many small businesses often use terms like “bookkeeper,” “controller,” and “CFO” interchangeably, not realizing the unique contributions each role offers.

When Should You Hire a CFO for Your Small Business? Exploring Qualifications, Skills, and the Benefits of a CFO

As your small business grows and reaches new heights, you’ll likely encounter various challenges related to financial management and strategic decision-making. At this critical juncture, you may find yourself contemplating whether it’s time to bring a Chief Financial Officer (CFO)

The Distinction between a CFO and a CEO: Roles and Responsibilities

In any organization, the roles of the Chief Financial Officer (CFO) and the Chief Executive Officer (CEO) are distinct but complementary. While both positions hold critical responsibilities in ensuring the company’s success, their areas of focus and expertise vary significantly.

The Crucial Role of a CFO in Business Success

Introduction: In today’s fast-paced business world, the position of Chief Financial Officer (CFO) has become more critical than ever before. The CFO plays a multifaceted role, overseeing financial strategies, risk management, and driving informed decision-making. In this blog post, we

24 Jul

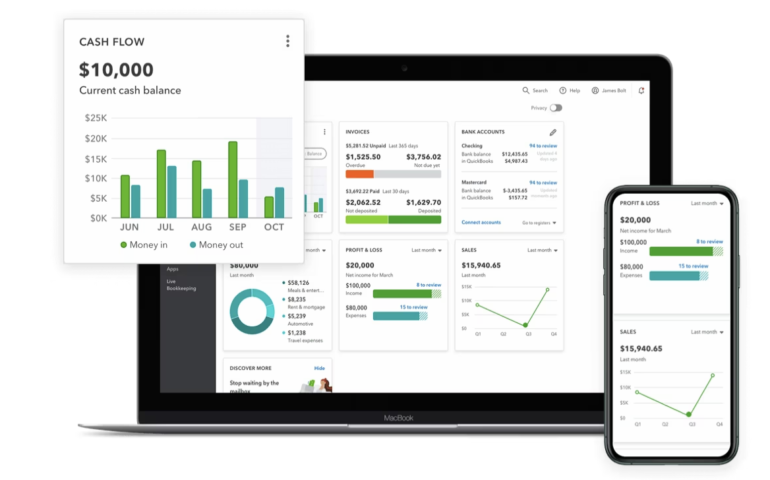

Streamlining Small Business Finances with Intuit’s QuickBooks Suite

Managing finances is a critical aspect of running a small business, and it can be overwhelming without the right tools and expertise. Fortunately, Intuit offers a comprehensive suite of financial solutions designed to simplify accounting processes for small business owners.

24 Jul

Unraveling QuickBooks Online Pricing: Choosing the Right Plan for Your Business

In this blog post, we will not only explore the various QuickBooks Online pricing plans but also delve into the compelling reasons why business owners should opt for a professional bookkeeping service like Small Business Accounting Inc.

01 Mar

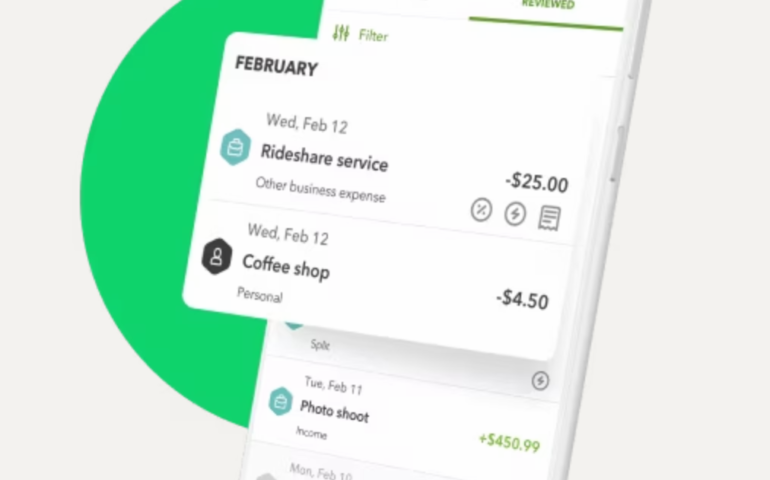

Mastering Your Finances: QuickBooks Self-Employed Simplifies Small Business Accounting

Running a small business can be both exciting and challenging. As a self-employed individual, staying on top of your finances is crucial for success. Fortunately, Intuit’s QuickBooks Self-Employed comes to the rescue as a powerful accounting tool tailored explicitly for