Description

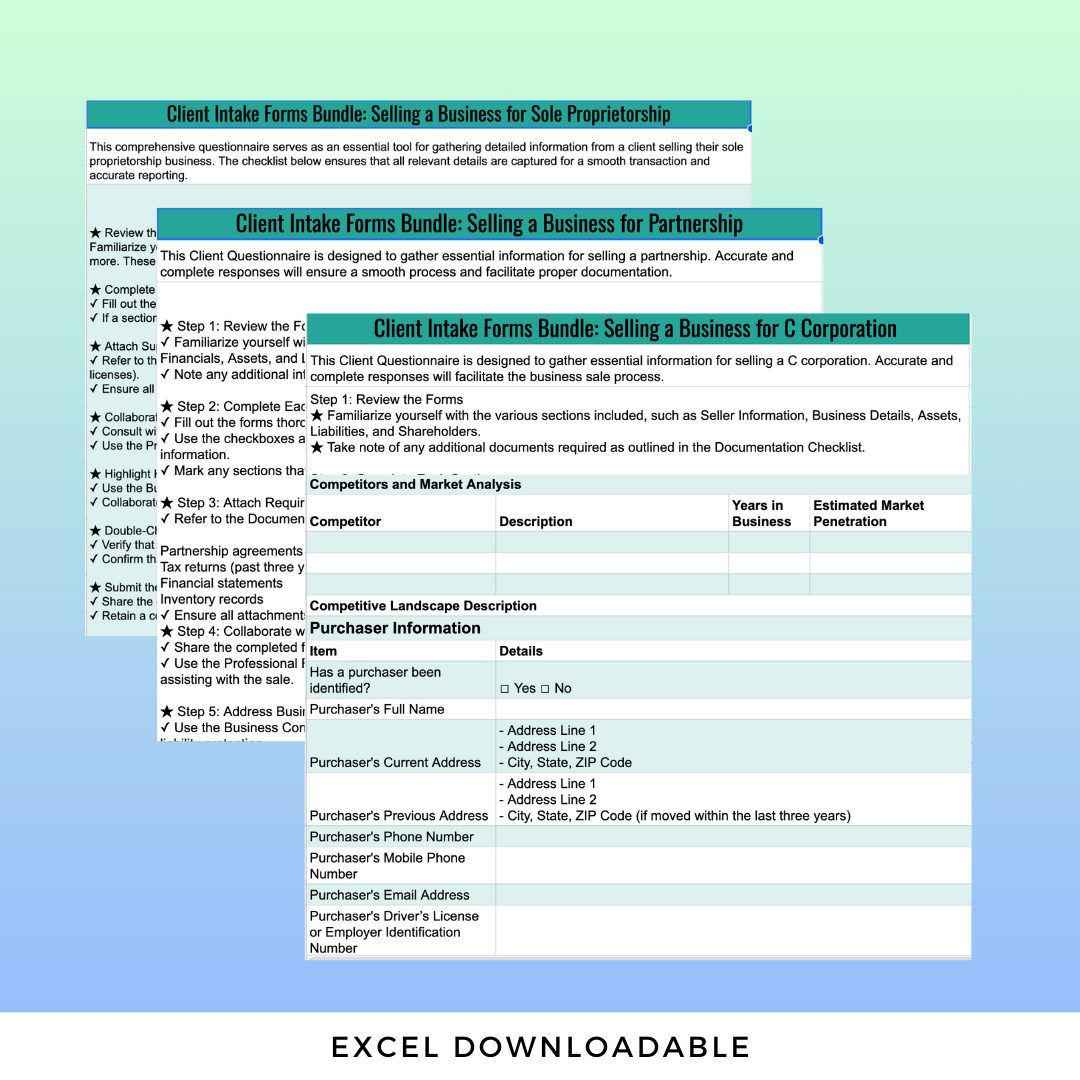

Selling a Business for C Corporation, Partnership, and Sole Proprietorship

Streamline your client onboarding process and simplify business sales with this all-in-one Client Intake Forms Bundle, expertly designed for accountants, tax professionals, and business advisors. Whether your client is selling a C Corporation, Partnership, or Sole Proprietorship, this bundle provides a comprehensive, professional, and user-friendly framework to capture every crucial detail efficiently.

What’s Inside the Bundle?

This bundle includes three meticulously crafted client intake forms, each tailored to the unique needs of different business types:

- C Corporation Client Intake Form

- Captures essential details about shareholders, board of directors, officers, stock qualifications (Section 1244/1202), assets, liabilities, and buy-sell agreements.

- Includes sections for intellectual property, compliance, and business valuation.

- Partnership Client Intake Form

- Addresses partnership-specific concerns, including partner contributions, profit-sharing arrangements, and operational roles.

- Guides professionals through partnership agreements, tax implications, and liabilities with precision.

- Sole Proprietorship Client Intake Form

- Designed for sole proprietors, focusing on personal and business assets, liabilities, tax considerations, and operational details.

- Includes tools to organize and analyze owner-specific information for seamless transactions.

Why Choose This Bundle?

Unlike single-purpose templates, this bundle delivers an integrated, versatile solution for professionals handling multiple business types. Each form is crafted to meet the highest standards of accuracy and comprehensiveness, ensuring:

- Full Coverage of Critical Details: From business operations and liabilities to compliance and taxation, every aspect is addressed.

- Professional Presentation: Impress clients with an organized and systematic approach to their business sale.

- Time-Saving Structure: Spend less time customizing and more time delivering value to your clients.

- Customizable Templates: Adapt the forms to specific client needs effortlessly.

- Instant Digital Access: Download the forms and start using them immediately.

Who Is This Bundle For?

- Accountants and CPAs: Simplify client onboarding with ready-to-use, professional-grade templates.

- Tax Professionals: Ensure compliance and accuracy in business sale reporting and planning.

- Business Advisors: Offer structured guidance to clients navigating the complexities of selling their businesses.

- Small Business Sellers: Use these forms to stay organized and provide your advisors with all the necessary information.

Key Features and Benefits

★ Three Business-Specific Forms: Tailored to address the nuances of C Corporations, Partnerships, and Sole Proprietorships, this bundle is perfect for multi-faceted professionals.

★ Detailed and User-Friendly: Features organized tables, checkboxes, and prompts to ensure nothing is overlooked.

★ Comprehensive Documentation Checklist: Includes a ready-to-use guide to collect supporting documents like financial statements, tax returns, and business agreements.

★ Supports Compliance and Risk Management: Helps identify gaps, liabilities, and compliance issues for smoother transactions.

★ Unmatched Value: Offers more than standalone forms for C Corporations, Partnerships, or Sole Proprietorships by bundling them together into one cohesive package.

Why This Bundle Stands Out

This product goes beyond ordinary templates by offering a one-stop solution for professionals who work with diverse client needs. Unlike other products, such as single-focus forms for partnerships or sole proprietorships, this bundle addresses all three entity types with equal depth and clarity.

How to Use This Bundle

- Select the Relevant Form: Choose the intake form specific to your client’s business type (C Corporation, Partnership, or Sole Proprietorship).

- Complete Each Section: Gather client information using the organized tables and prompts to ensure every detail is covered.

- Attach Supporting Documentation: Use the included checklist to ensure all necessary documents are collected and organized.

- Collaborate with Advisors: Share the completed forms with attorneys, accountants, or business advisors to streamline the process.