Description

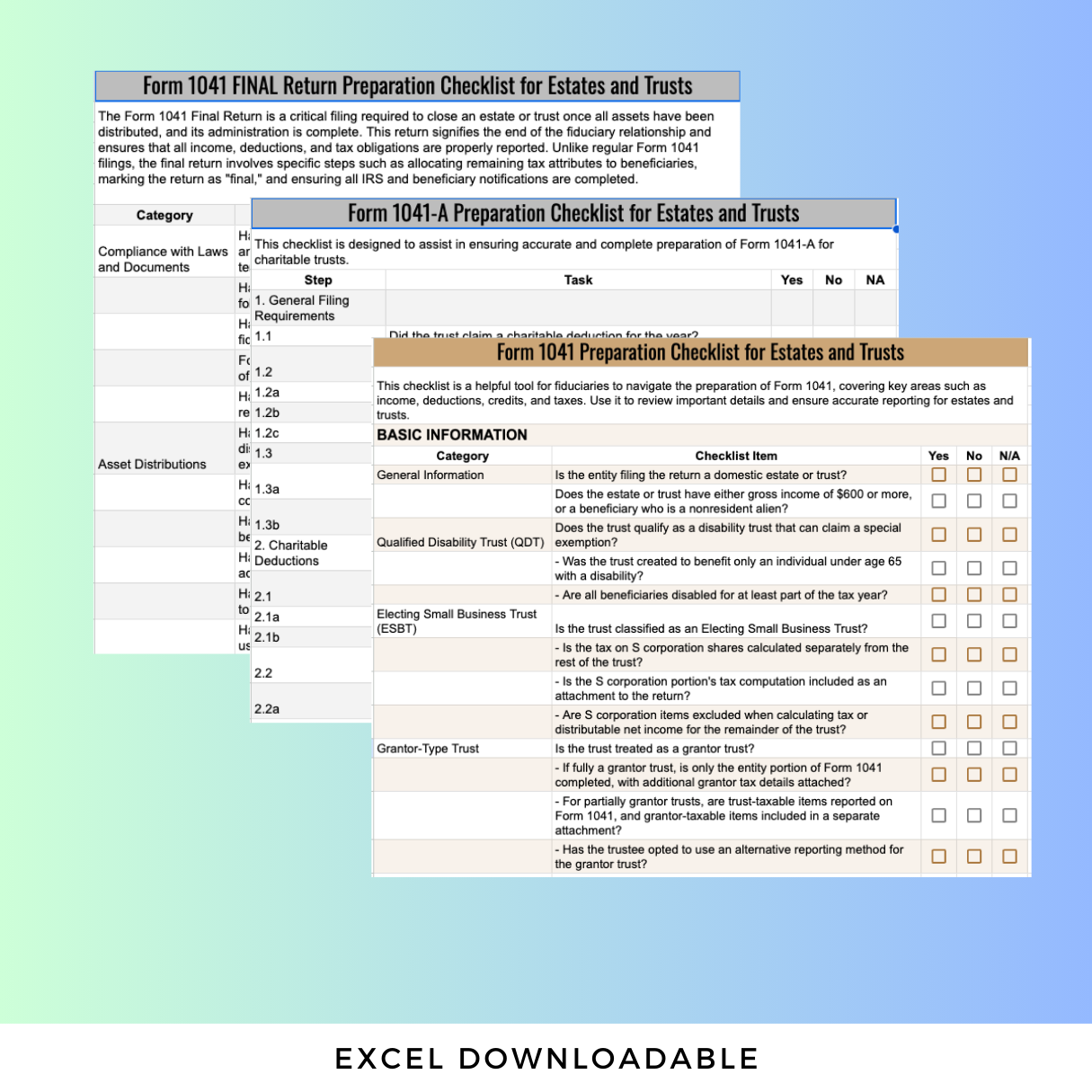

Navigating the complexities of preparing Form 1041-A can be challenging for trustees and tax professionals alike. Our Form 1041-A Preparation Checklist is meticulously designed to simplify the process, ensuring you meet IRS compliance standards while saving time and avoiding costly mistakes.

This comprehensive tool is tailored specifically for charitable trusts and covers every critical detail, from determining filing requirements to properly reporting charitable deductions, set-asides, and distributions. Whether you’re managing a trust with significant income or claiming deductions for charitable purposes, this checklist provides step-by-step guidance to streamline your reporting process.

Key Features of the Checklist:

- Filing Requirements: Determine whether the trust qualifies for exemptions or meets the filing thresholds.

- Charitable Deductions: Ensure accurate itemization of deductions, including payee names and addresses, as required by the IRS.

- Income and Set-Asides: Verify gross income reporting and deductions for amounts permanently set aside for charitable purposes.

- Corpus Distributions: Track and report distributions of corpus for charitable purposes in current or prior years.

- User-Friendly Format: Organized in a clear, actionable format to help you work efficiently.

Whether you’re preparing returns for a charitable trust, split-interest trust, or a trust claiming deductions under Section 642(c), this checklist is your go-to resource. With easy-to-follow steps, it helps you stay compliant, avoid penalties, and confidently file Form 1041-A.

Why Choose This Checklist?

- Expertly Designed: Developed with input from tax professionals to address every aspect of Form 1041-A preparation.

- Time-Saving: Reduces time spent searching for IRS instructions by consolidating requirements in one comprehensive guide.

- Peace of Mind: Avoid errors and ensure your filings are accurate and complete.

Who Is It For?

- Trustees managing charitable trusts.

- Tax professionals preparing returns for trusts with charitable deductions.

- Estate planners ensuring compliance with IRS filing requirements.

Don’t let the complexity of Form 1041-A hold you back. Use this checklist to simplify the preparation process, ensure compliance, and focus on what matters most: managing your trust effectively and efficiently.